Electric Forklift Depreciation Rates: What Your 2-Ton Model Will Be Worth in 5 Years

The electric forklift market in the USA keeps on growing fast with the 2-ton electric forklift being a major point of numerous manufacturing, warehousing, and industrial facilities. The question of how you depreciate your investment if you own a single lift or a fleet is very important for budgeting, resale planning, and operational strategy. By reading this in-depth guide, you will acquaint yourself with the concept of electric forklift depreciation, be able to determine the market value after five years and recognize the ways of extending the lifespan and increasing the resale value of your 2-ton electric forklift.

Why Electric Forklift Depreciation Matters?

Electric forklifts are quite an expensive venture and, like all business assets, their value will go down with time and usage.

- The electric forklift depreciation is more than just an accounting term—it has a direct bearing on your return on investment, total cost of ownership, tax deductions, and resale prospects.

- Electric forklifts lose their value at a slower rate than internal combustion (IC) models, which is partly due to the fact that there are fewer moving parts and the battery technology has improved. This means that in most cases, they retain value better over time.

- Depreciation monitoring is the key to correct equipment budgeting and end-of-life planning. Depreciation tracking thus enables business owners to budget for equipment replacement before expensive failures, while at the same time maximize residual value.

- The IRS permits quite a few depreciation deductions, particularly in 2025 when the enhanced Section 179 and 100% bonus depreciation are back, thus directly affecting your net result with the tax saving that can be achieved.

Knowing these fundamental rules will allow you to take acquisition and fleet management decisions based on data and with confidence.

How Electric Forklift Depreciation Is Calculated?

Electric Forklift Depreciation may be determined by different accounting methods, but the two most popular ones are straight-line and double-declining balance (accelerated) depreciation. The selection of the method depends on your company’s accounting strategy and tax planning objectives.

- Straight-Line Depreciation: The expense of the forklift is evenly spread through its useful life. The formula is:

This method works great for budgeting as it generates predictable expenses every year.

- Double-Declining Balance (DDB): Accelerated depreciation technique that recognizes very little value is left in the first few years and therefore most of it is written off in these years. It is a method that is particularly beneficial to businesses that want a substantial reduction of their taxable income in the first years of the ownership.

For the majority of forklifts, accountants also take into account the actual hours of use and not only years, a low-mileage 5-year-old lift may be worth more than a heavily used one of the same age.

For accounting purposes, the average electric forklift is depreciated over a period of 5 to 7 years, however, the effective market value drops the fastest during the first three years and then decreases at a slower rate as the equipment gets older.

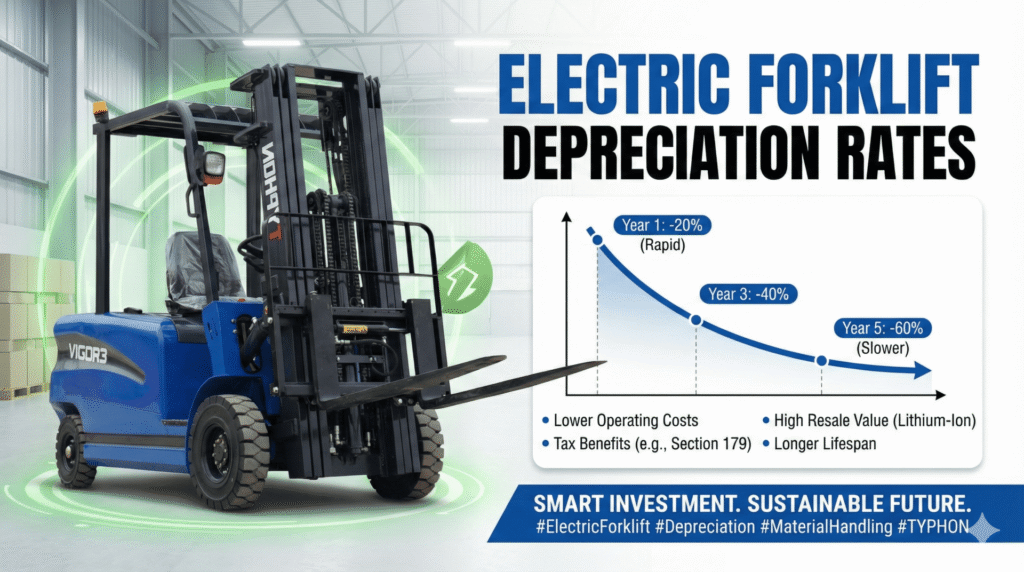

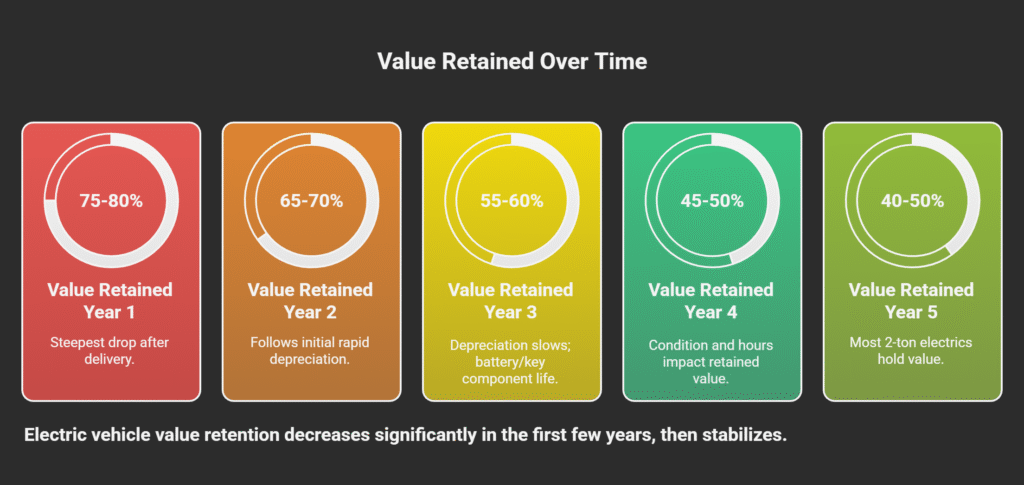

2-Ton Electric Forklifts Depreciation Rates for: Year-by-Year Breakdown

To come up with the figure of the value of the resale after five years, first, you have to be aware of the industry-standard depreciation rates:

| Year of Ownership | Value Retained (%) | Notes |

| 1 | 75–80 | Steepest drop; value declines after delivery |

| 2 | 65–70 | Follows initial rapid depreciation |

| 3 | 55–60 | Depreciation slows; battery/key component life |

| 4 | 45–50 | Condition and hours impact retained value |

| 5 | 40–50 | Most 2-ton electrics hold 40–50% after 5 yrs |

During the first year, electric forklifts are generally depreciated by about 20–25%, and then through the usual 5-year term, they lose 10–15% of their value per year. The top of the range (near 50%) at year five for well-maintained models with complete service records.

Factors That Affect Depreciation Rate and 5-Year Value

Age alone will not determine the value of your forklift after five years. Several other factors will determine that. Knowing these will allow you to increase the retained value and take resale into consideration.

- Hours of Use: Similar to vehicle mileage, total operating hours determine to the greatest extent the value of the unit. Those units which have less than 8,000 hours after 5 years are able to sell at the highest resale prices.

- Maintenance Records: A complete and fully documented service history can increase the resale value of a unit by 20–30% as compared to the units that have no records.

- Brand & Model: The brand that is considered a premium one and a standard, non-specialized model will slow down the depreciation process. On the contrary, the obscured or obsolete models, or those with discontinued parts, drops rapidly.

- Battery Condition: In the case of electrics, the most important factors are the life of the battery and the replacement history. The resale value will be at the highest point if the battery is almost new or has been recently upgraded.

- Market Demand & Timing: The changes in demand due to seasons and the disruptions of the supply chain can have substantial effects on used values. The sellers during a supply squeeze period (like in 2021–2022) will get more for their goods.

- Aesthetics & Wear: Value can be impacted by 10–20% due to dents, rust, and other types of minor damage. First impressions matter even in industrial resale markets.

What Will Your 2-Ton Electric Forklift Be Worth After 5 Years?

Let’s take an example of a 2-ton electric forklift which you purchased new for $35,000 in 2025. Based on a normal depreciation pattern, this is probably where it will be by 2030:

- After Year 1: Value: $26,250 – $28,000 (75–80% retained)

- After Year 3: Value: $19,250 – $21,000 (55–60% retained)

- After Year 5: Value: $14,000 – $17,500 (40–50% retained)

| Year | Approximate Value ($) | Percentage Retained |

| 1 | $26,250–$28,000 | 75–80% |

| 3 | $19,250–$21,000 | 55–60% |

| 5 | $14,000–$17,500 | 40–50% |

- The table is a reflection of good condition forklifts that have been used for the average commercial usage (1,500–2,000 hours per year).

- Higher annual hours of use or poor maintenance will result in lower resale value, sometimes even below 35% after five years.

- At the time of selling, a new or recently replaced battery can raise the value by 10–15%.

Direct selling or selling through trustworthy online platforms is what normally gives the highest return, while trade-ins and auction offers are good for quick but low volume returns.

How to Slow Electric Forklift Depreciation and Maximize Resale Value

The below excellent practices will help you keep more of the value of your forklift and thus, more of your investment will be returned to you at the five-year point:

- Ensure that all scheduled maintenance is done and make a detailed record of the services for the buyers; a tracked history adds 20–30% in value.

- Store lifts inside or in a covered place to avoid rust and wear caused by weather.

- It would be wise to replace or recondition batteries in your fourth or fifth year if that is at all possible; a decent battery is often a more important factor than low hours when it comes to resale of electric units.

- Deal with the cosmetic problems (seats, paint, forks) ahead of the sale; appearance can influence buyer psychology just as much as technical stats.

- Perform sales when the demand is at its peak, for instance, right before the warehouse or construction seasons and be cautious of industry-wide supply shortages.

For the best price, go for direct selling, established and trustworthy platforms or selling to the final user; if you want to get rid of the product quickly, then use trade-ins and auctions, but you will have a lower return.

2025 Tax Rules and Depreciation Deductions for Electric Forklifts

- The year 2025 is going to be very generous in terms of U.S. tax treatments for capital equipment such as electric forklifts. It includes Section 179 and bonus depreciation.

- The Section 179 deduction limit is $2.5 million, thus, most businesses will be able to deduct the full cost of their forklift purchase in the very first year.

- 100% bonus depreciation is for the qualifying new and used equipment that is acquired in 2025 only. Also, the Section 179 and bonus depreciation can be stacked for the maximum benefit.

- It is always a good idea to talk to a certified tax specialist who can help you confirm your eligibility and figure out the best depreciation/tax strategy for your business.

Common Depreciation and Resale Value Mistakes to Avoid

These five mistakes, if committed, will cause your investment to lose its value, and thus, after five years, you will have a hard time retaining strong value:

- Ignoring Usage Hours: Never judge the lifts by their ages only—don’t forget that the hours matter more for future buyers as well as for service life.

- Maintenance Documentation Skipping: The failure in documenting every service or repair hurts buyer trust and resale value.

- Underestimating Battery Impact: Most of the time, the battery is half of the lift’s value in the resale market. So, it is very important that you always disclose the type, age, and condition.

- Waiting for Major Repairs: It is better to sell your product before the time for the big repairs or battery replacements comes. In this way, the returns will be higher.

- Market Cycles Misjudgment: Make a decision whether to hold or sell at the right time; do not offload during the seasonal slow periods unless it is necessary.

- Not Shopping Sales Channels: Find out what selling options are best for your market and specification: direct sale, auction, or trade-in.

FAQs on Electric Forklift Depreciation Rates

What is the average annual electric forklift depreciation rate?

The majority of electric forklifts lose 15–20% of their value annually. Most consist of rapid loss of value during the first year and 10–15% each year thereafter. A well-maintained model and a brand of a high standard will retain more value.

How is Depreciation Calculated for Electric Forklifts?

The most prevalent method is straight-line depreciation. A business subtracts the estimated salvage value from the purchase price and then divides it by the expected useful life in years. Companies can also opt for accelerated methods such as double-declining balance to get tax benefits.

What Factors Most Affect 5-Year Resale Value on 2-ton Electric Lifts?

The primary determinants of 5-year value are the operating hours, maintenance history, battery condition, brand, and market demand. Especially for electrics, the battery age and replacement history matter a lot.

Are Electric Forklifts a Better Investment Than Diesel or LPG Models?

One of the reasons electric forklifts are often less rapidly depreciated is due to the fact that the operational wear is lower, less maintenance is required, and there is a growing demand for eco-friendly products. Nevertheless, the initial costs together with battery replacements affect the ROI.

How Important Is the Battery for Resale Price?

It is extremely important. A brand new or barely used battery at the 5-year point can increase the resale value by 10–15%. We can assume that buyers will shy away from lifts with the original battery that is only partially charged and that they will replace it soon without their being informed.

Can I Claim 100% Depreciation in One Year for a Forklift Purchased in 2025?

Certainly, according to new IRS rules for 2025, Section 179 and bonus depreciation are the factors that let eligible businesses make an expense of up to $2.5 million (Section 179 limit) and claim 100% bonus depreciation for the qualifying equipment, including both new and used forklifts.

What Are Typical Selling Options for a 5-year-old 2-ton Electric Forklift?

Usually, the direct sell to an end user or through an online marketplace is what gives the highest price (70–90% of residual value), whereas, trade-in with dealers and auctions are quicker but offer a lower price (50–80% of the value). You will determine the sales channel based on your time, convenience, and financial goals.

Summary Electric Forklift Depreciation – Strategic Planning for Long-Term ROI

Electric Forklift Depreciation and resale value planning carefully should be the basis of every forklift acquisition strategy. It is your 2-ton electric forklift that, with proper maintenance, timing, and channel selection, will become a substantial part of the original value even after five years. Use the 2025 new tax incentives to get extra savings, and remember: getting the most out of your machine starts from day one of your ownership, not just at the end of its useful life.

For more unbiased forklift insights, maintenance tips, or resale strategies, delve deeper into the complete American Forklifts blog and elevate your fleet management with the help of expert knowledge and practical tools.